In order to manage these risks the entity may enter into currency hedging contracts which could be one of four types. Lets say a us investor buys a foreign asset thats denominated in british pounds.

Currency Hedging How To Avoid Risk In Fx Fluctuations

Currency Hedging How To Avoid Risk In Fx Fluctuations

Notably for businesses that have a predictable cash flow from a foreign country in a foreign currency rolling hedges may be useful in protecting that businesss cash flow from swings in foreign exchange rates.

Fx currency hedging. You might find yourself hedging against foreign exchange risk if you own an overseas asset. This is typically achieved by buying futures contracts or options that will move in the opposite direction of the currencies held inside of the fund. The basics the most basic form of hedging is where an investor wants to mitigate currency risk.

Were going to concentrate on using the spot fx market. Currency hedging in the context of bond funds is the decision by a portfolio manager to reduce or eliminate a bond funds exposure to the movement of foreign currencies. What is forex hedging and how do i use it.

Von englisch to hedge hd mit einer hecke umzaunen bezeichnet ein finanzgeschaft zur absicherung einer transaktion gegen finanzrisiken wie preis oder wechselkurs schwankungen siehe auch volatilitat. Ein hedgegeschaft oder sicherungsgeschaft auch ab! sicherung oder kurssicherung kurz auch hedging. A foreign exch! ange hedge transfers the foreign exchange risk from the trading or investing company to a business that carries the risk such as a bank.

And lets say that your. For example lets say you live in the uk and invested in nintendo shares before the success of pokemon go and you subsequently profited majorly after the fact. A forex hedge is a foreign currency trade thats sole purpose is to protect a current position or an upcoming currency transaction.

In this currency hedging guide were going to outline a few standard and out of the box currency risk hedging strategies. Hedging currency risk is a useful tool for any savvy investor that does business internationally and wants to mitigate the risk associated with the forex currency exchange rate fluctuations. There is cost to the company for setting up a hedge.

By setting up a hedge the company also forgoes any profit if the movement in the exchange rate would be fa! vourable to it. Forex traders can be referring to one of two related strategies when they engage in hedging. Hedging is a strategy to protect ones position from an adverse move in a currency pair.

Forward contract futures contract interest rate swaps and options. Foreign exchange fx hedging can be a useful tool when seeking to mitigate foreign exchange rate risk.

Commentary Savvy Cfo Strategies For Hedging Foreign Exchange Risk

Commentary Savvy Cfo Strategies For Hedging Foreign Exchange Risk

Weird But Effective How The Most Of Forex Hedge Can Be Done

Weird But Effective How The Most Of Forex Hedge Can Be Done

Dynamic Hedging

Dynamic Hedging

How To Use Hedging In Forex Trading

How To Use Forex Trading Hedging Strategy Learn To Trade Fx Markets

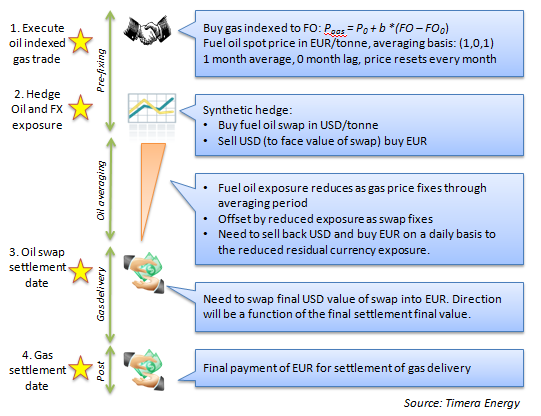

Bleeding Value From Residual Foreign Exchange Risk Timera Energy

Bleeding Value From Residual Foreign Exchange Risk Timera Energy

Hedge Accounting Ias 39 Vs Ifrs 9 Ifrsbox Making Ifrs Easy

Hedge Accounting Ias 39 Vs Ifrs 9 Ifrsbox Making Ifrs Easy

Foreign Currency Exposure And Hedging In Australia Bulletin

Foreign Currency Exposure And Hedging In Australia Bulletin

Foreign Exchange Options Hedging A Corporate Long Exposure In

Foreign Exchange Options Hedging A Corporate Long Exposure In

Chapter 13 Hedging Foreign Exchange Risk

Cross Currency Basis What Is It And What Are The Implications

Cross Currency Basis What Is It And What Are The Implications

Foreign Currency Exposure And Hedging In Australia Bulletin

Foreign Currency Exposure And Hedging In Australia Bulletin

Forex Trading Strategie Sure Fire Hedging

How To Use Hedging In Forex Trading

Forex Hedging Strategy Always In Profit Unterschied Welthandel

0 Response to "Fx Currency Hedging"

Posting Komentar